Companies House Late Filing Penalty, Late Filing Penalties Liverpool Chamber Of Commerce

Companies house late filing penalty Indeed lately is being sought by consumers around us, maybe one of you. Individuals are now accustomed to using the net in gadgets to view video and image data for inspiration, and according to the name of the post I will talk about about Companies House Late Filing Penalty.

- 2

- Penalties And Sanctions Part 1 Dns Accountants

- How To Pay Companies House Late Filing Penalties Youtube

- Companies House Gibraltar Covid 19 90 Day Extension Without Penalty Facebook

- Important Fraud Notice From Companies House Warning Late Filing Penalty Scam Company Formation Madesimple

- Known Fraud And Scams Gov Uk

Find, Read, And Discover Companies House Late Filing Penalty, Such Us:

- 2

- What Is House Beta Web Check Companies House Accounting House

- Latest Companies House Presentation Nov 2014

- Https Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File 835369 Lfpmanual V11 Pdf

- Sexty Co

If you re searching for Buying A New House Meme you've come to the right place. We ve got 101 graphics about buying a new house meme adding images, pictures, photos, backgrounds, and much more. In these page, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Hmrc issue two types of self assessment penalties those for late filing and for late payment of owed tax.

Buying a new house meme. You have 9 months after the companys year end to file your accounts with companies house. In order to avoid companies house late filing penalties you need to get your accounts in on time. The self assessment tax year runs from 6 april to 5 april next year.

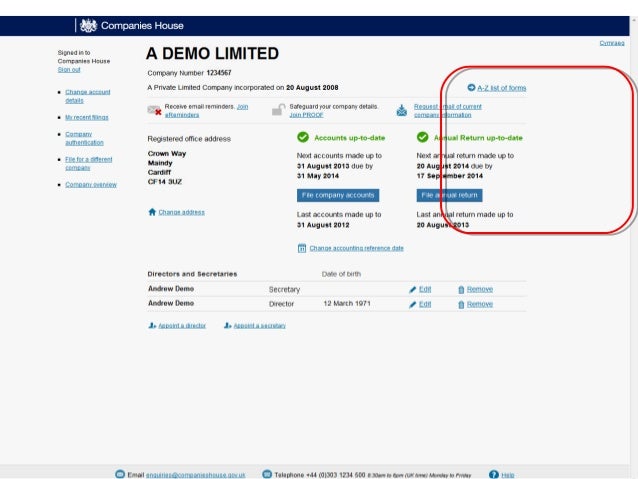

Companies house private limited company. The reference number on the penalty notice. You can be fined and your company struck off the register if you do not send companies house your accounts or confirmation.

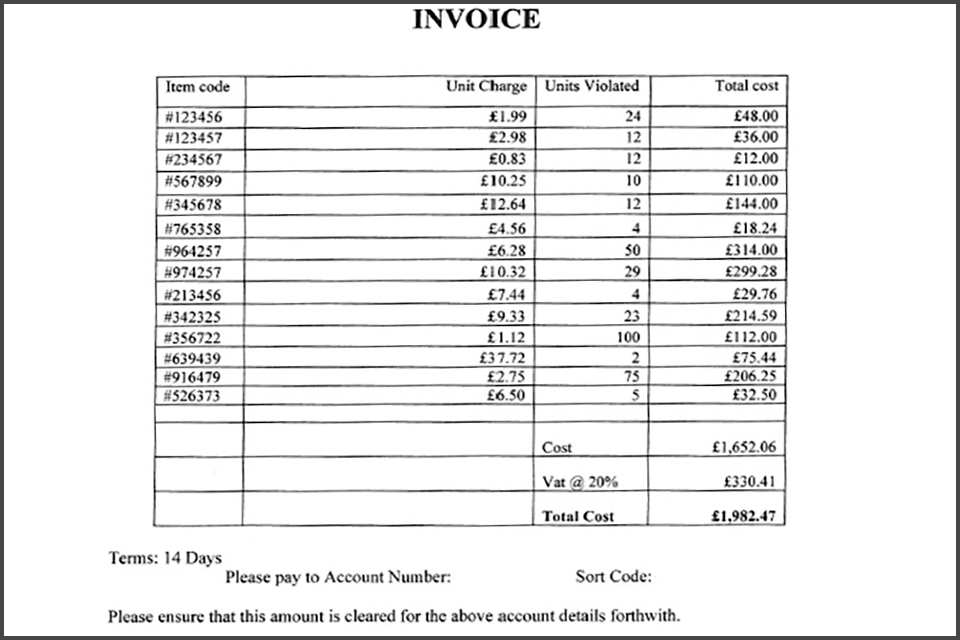

The purpose of the late filing penalty scheme is to promote the timely delivery of accounts to companies house. Appeals based upon covid 19 will be considered under these policies. In this article youll find the full breakdown of all the late filing penalties and late payment fines which hmrc andor companies house may charge in case of any sort of non compliances.

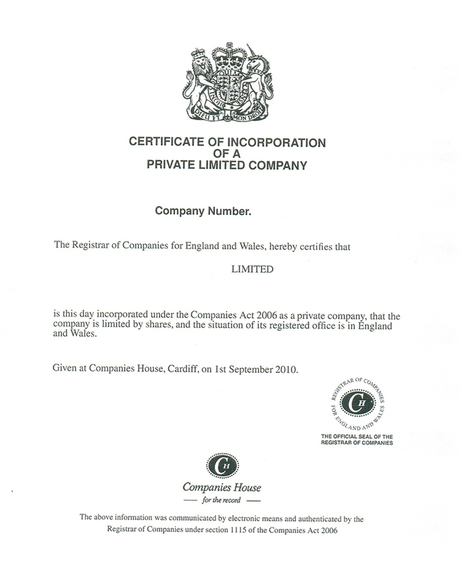

So for example if your year end is 31st march 2016 then you have until 31st december. A private companys set of acceptable accounts for the accounting period ending 30 september 2009 would need to be delivered by 30 june 2010 to avoid a late filing penalty. A credit or debit card.

Use this service if youve received a penalty notice from companies house for filing your companys annual accounts late. Updated bacs details with new companies house bank account. Its the legal responsibility of the companys officers to make sure accounts are prepared and delivered to companies house on time.

A companies house account youll be able to create one if you do not have one already. It may take up to 30 minutes to complete this application. If a late filing penalty is issued to your company you may appeal against it.

Appeal a late filing penalty. Confused about small business tax. During the financial year from 2017 to 2018 we levied 218884 penalties with a value of 937m.

So the current tax year is 6 april 2020 to 5 april 2021. You can appeal a late filing. The penalty is doubled if your accounts are late 2 years in a row.

If your late filing penalty occurred on or after 30 march 2020 you may be able to pay your late filing penalty online. Use this service to appeal a penalty issued to a company for not filing its annual accounts on time. The registrar of companies already has policies in place to deal with appeals based upon unforeseen poor health.

Each appeal is treated on a case by case basis.

More From Buying A New House Meme

- House For Sale In Orchards Johannesburg

- Funghi Simili A Mazza Di Tamburo

- Most Expensive House For Sale In California

- House For Sale New York

- Pistola A Tamburo Softair

Incoming Search Terms:

- Fake Emails Seemingly From Companies House Mcphersons Chartered Accountants In Bexhill And Hastings Pistola A Tamburo Softair,

- Companies House Presentation July 2014 Pistola A Tamburo Softair,

- Companies House Pistola A Tamburo Softair,

- Known Fraud And Scams Gov Uk Pistola A Tamburo Softair,

- Assistance With Paying A Penalty At Companies House Dns Accountants Pistola A Tamburo Softair,

- 2 Pistola A Tamburo Softair,