Companies House Late Filing Penalty Payment, Late Filing Penalties Gov Uk

Companies house late filing penalty payment Indeed lately has been hunted by users around us, maybe one of you. People now are accustomed to using the net in gadgets to view video and image data for inspiration, and according to the name of this article I will talk about about Companies House Late Filing Penalty Payment.

- 1

- 2

- Hmrc Companies House Late Filing Penalties In Uk Dns Accountants

- Https Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File 597755 Disc Log 411request For Details Of Companies House Backup System For Office 365 Data Pdf

- Giffgaff Accounts Overdue At Companies House The Giffgaff Community

- 2

Find, Read, And Discover Companies House Late Filing Penalty Payment, Such Us:

- 25 000 Companies Receive Penalties For The Late Filing Of Accounts In Just One Month Knights Lowe

- Late Filing Penalties Companies House Hmrc Online Account Filing

- Hmrc Companies House Late Filing Penalties In Uk Dns Accountants

- The Confirmation Statement Explained

- What Are The Hmrc Late Filing Penalties For Limited Companies Ycf

If you are looking for Companies House Northern Ireland you've come to the right location. We have 102 graphics about companies house northern ireland including pictures, photos, pictures, backgrounds, and more. In such webpage, we additionally provide number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Giffgaff Accounts Overdue At Companies House The Giffgaff Community Companies House Northern Ireland

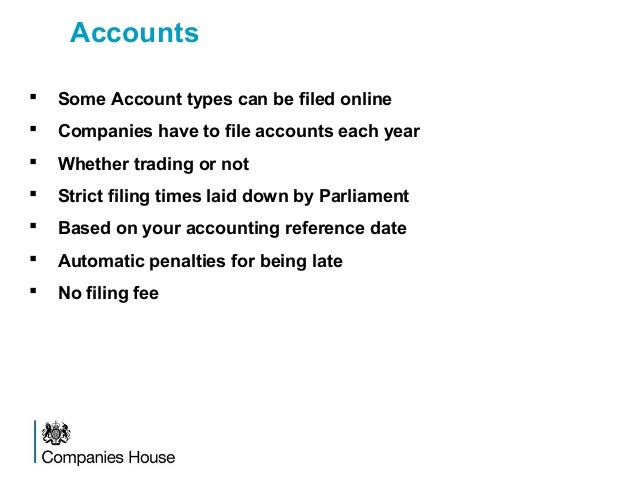

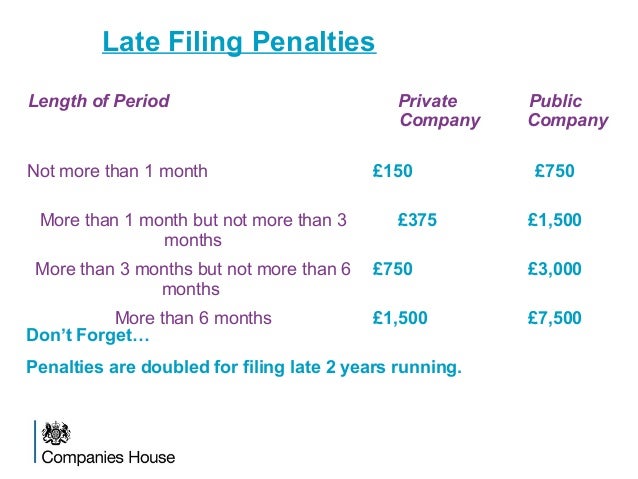

In this article youll find the full breakdown of all the late filing penalties and late payment fines which hmrc andor companies house may charge in case of any sort of non compliances.

Companies house northern ireland. Also the message below says i cant pay if penalty was after 30th march 2020. You have 30 days from the date on the paye late penalty notice to pay or appeal it. Appeal a late filing penalty.

The penalty is doubled if your accounts are late 2 years in a row. The registrar of companies already has policies in place to deal with appeals based upon unforeseen poor health. How to pay a paye late payment or filing penalty including payment methods reference numbers.

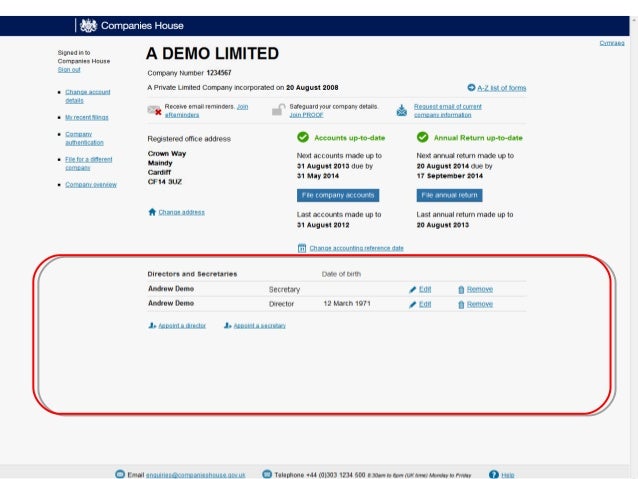

The reference number on the penalty notice. A private companys set of acceptable accounts for the accounting period ending 30 september 2009 would need to be delivered by 30 june 2010 to avoid a late filing penalty. It may take up to 30 minutes to complete this application.

You can be fined and your company struck off the register if you do not send companies house your accounts or confirmation. A companies house account youll be able to create one if you do not have one already. If a late filing penalty is issued to your company you may appeal against it.

Appeals based upon covid 19 will be considered under these policies. You will find a link to the online service on your penalty notice. Paye late filing of rti submissions result in automatic hmrc penalties of 100 per late submission.

The self assessment tax year runs from 6 april to 5 april next year. You should pay the late filing penalty if you cannot show that your reasons for filing late were exceptional. If your late filing penalty occurred on or after 30 march 2020 you may be able to pay your late filing penalty online.

Ksi have a letter from companies house with an online link but the link just brings me into the web page explaining penalties and how to file etc. Use this service to appeal a penalty issued to a company for not filing its annual accounts on time. So the current tax year is 6 april 2020 to 5 april 2021.

More From Companies House Northern Ireland

- Mazze Tamburo Trifolate

- House For Rent In Tampa Florida

- Le Mazze Di Tamburo Si Possono Congelare

- House For Sale By Lucifer Lyrics

- Grand Designs House For Sale Scotland

Incoming Search Terms:

- How To Submit Amended Accounts To Companies House Online Grand Designs House For Sale Scotland,

- Iras Late Filing Or Non Filing Of Tax Returns Grand Designs House For Sale Scotland,

- Companies House Late Filing Penalties Churchgates Grand Designs House For Sale Scotland,

- 1 Grand Designs House For Sale Scotland,

- What Is A Compulsory Strike Off Company Rescue Grand Designs House For Sale Scotland,

- Companies House Archives Iab International Association Of Bookkeepers Grand Designs House For Sale Scotland,