Companies House Late Filing Penalty Tax Deductible, Late Filing Penalties Gov Uk

Companies house late filing penalty tax deductible Indeed recently is being hunted by users around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the title of this article I will talk about about Companies House Late Filing Penalty Tax Deductible.

- Publication 17 2019 Your Federal Income Tax Internal Revenue Service

- Https Www Pwc Com Ng En Assets Pdf Finance Bill Insights Pdf

- Https Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File 835369 Lfpmanual V11 Pdf

- Iras Tax Season 2019 File Taxes Early From 1 Mar

- Iras Late Filing Or Non Filing Of Tax Returns

- Https Www2 Deloitte Com Content Dam Deloitte Id Documents Tax Id Tax Indonesian Tax Guide 2019 2020 En Pdf

Find, Read, And Discover Companies House Late Filing Penalty Tax Deductible, Such Us:

- Itr Filing Missed Itr Filing You Might Pay Penalty Even If Income Is Below Exemption Limit The Economic Times

- Covid 19 Excel Table

- The Loan Charge Here S How To Deal With It Low Incomes Tax Reform Group

- Hmrc Vat And Paye Late Payment Penalties And Interest Rates Company Debt

- Iras Late Filing Or Non Filing Of Tax Returns

If you re searching for Companies House Data Breach you've come to the perfect place. We ve got 100 graphics about companies house data breach adding images, pictures, photos, backgrounds, and more. In these webpage, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

You cant appeal against it.

Companies house data breach. Wed aug 06 2008 349 pm. If your late filing penalty occurred on or after 30 march 2020 you may be able to pay your late filing penalty online. 5 of tax due 300 depending on which is the greatest sum 12 months.

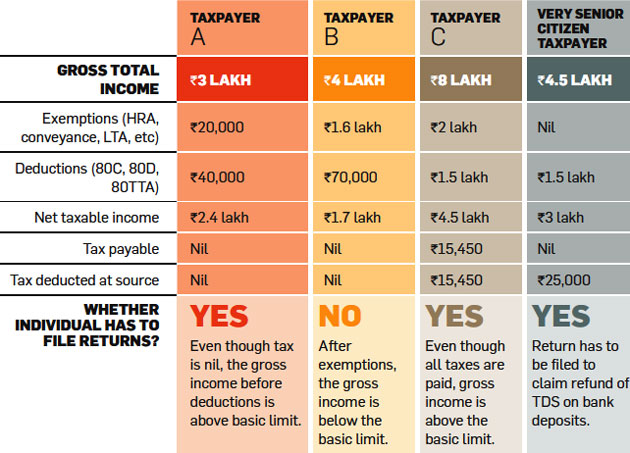

Follow peters advice and net off the accountants contribution of 500 against the penalty of 750 and disallow the balance of 250 in the tax computations. If your tax return is late three times in a row the 100 penalties are increased to 500 each. Are late filing penalties arising from companies house allowable as a deduction for against profits for corporation tax.

3 posts page 1 of 1. To make matters worse penalties arent even tax deductible expenses. Penalties are not deductible from the companys profits for tax purposes.

5 of tax due from that period. If your tax return is six months late hmrc will write telling you how much corporation tax they think you must pay. 5 of tax due.

A private companys set of acceptable accounts for the accounting period ending 30 september 2009 would need to be delivered by 30 june 2010 to avoid a late filing penalty. The fact that the accountant may or may not have caused the delay in filing is irrelevant. Late filing of rti submissions result in automatic hmrc penalties of 100 per late.

Post by lolar mon aug 18 2008 1103 pm. Money and tax. This is called a tax determination.

5 of tax due from that period. Filing your companies house information online. Late penalty calculator late filing penalty calculator.

So the current tax year is 6 april 2020 to 5 april 2021. You must pay the corporation tax due and file your tax return. Fines and penalties of any sort are not tax deductible except where your business pays them on behalf of an employee.

10 daily charge for the first 90 days. In this article youll find the full breakdown of all the late filing penalties and late payment fines which hmrc andor companies house may charge in case of any sort of non compliances. The self assessment tax year runs from 6 april to 5 april next year.

Apart from fees linked to reorganising share capital company admin costs for example fees for preparing and submitting documents to companies house etc are tax deductible.

More From Companies House Data Breach

- Pistola A Salve Bruni A Tamburo

- Tossico Mazza Tamburo Velenosa

- Adelaide House Prices

- Companies House Beta 2

- House For Sale Bangkok Thonglor

Incoming Search Terms:

- Late Filing And Payment Penalties Inniaccounts House For Sale Bangkok Thonglor,

- Is The Tax Deadline Delayed What To Know About Coronavirus Covid 19 And Your Taxes The Turbotax Blog House For Sale Bangkok Thonglor,

- Hmrc Scraps Millions In Self Assessment Penalty Fines Financial Times House For Sale Bangkok Thonglor,

- Simple Tax Guide For Americans In Taiwan House For Sale Bangkok Thonglor,

- Income Tax In India Wikipedia House For Sale Bangkok Thonglor,

- Https Www2 Deloitte Com Content Dam Deloitte Pk Documents Tax Budget 2020 21 Highlights Comments Deloittepk Noexp Pdf House For Sale Bangkok Thonglor,