Companies House Late Filing Penalties, Latest Companies House Presentation Nov 2014

Companies house late filing penalties Indeed lately is being hunted by consumers around us, maybe one of you. People now are accustomed to using the net in gadgets to view image and video information for inspiration, and according to the title of the post I will talk about about Companies House Late Filing Penalties.

- Companies House Gibraltar Covid 19 90 Day Extension Without Penalty Facebook

- What Is House Beta Web Check Companies House Accounting House

- Changes To Companies House Striking Off Policies And Late Filing Penalties Corporate Commercial Law Uk

- New Late Filing Penalties From Companies House

- Companies House Annual Requirements Macauleyjamesandco Com

- Assistance With Paying A Penalty At Companies House Dns Accountants

Find, Read, And Discover Companies House Late Filing Penalties, Such Us:

- Companies House Annual Requirements Macauleyjamesandco Com

- What Is A Compulsory Strike Off Company Rescue

- Late Filing Penalties For Ltd Companies

- Companies House Gibraltar Covid 19 90 Day Extension Without Penalty Facebook

- Stephens Scown On Twitter Concerned About Late Filing Penalties And Strike Offs During The Coronavirus Pandemic Companies House Has Announced Temporary Measures To Support Companies Paralegal Jo Price Explains Https T Co Tbdnvxbzkt Business

If you re looking for House Prices Glasgow Road Blantyre you've arrived at the right place. We ve got 100 graphics about house prices glasgow road blantyre including pictures, photos, photographs, wallpapers, and more. In such web page, we additionally have number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Youll have to pay penalties if you do not file your accounts with companies house by the deadline.

House prices glasgow road blantyre. Late filing penalties if a late filing penalty is issued to your company you may appeal against it. If your tax return is late three times in a row the 100 penalties are increased to 500 each. The penalties will be doubled if a company files its accounts late in 2.

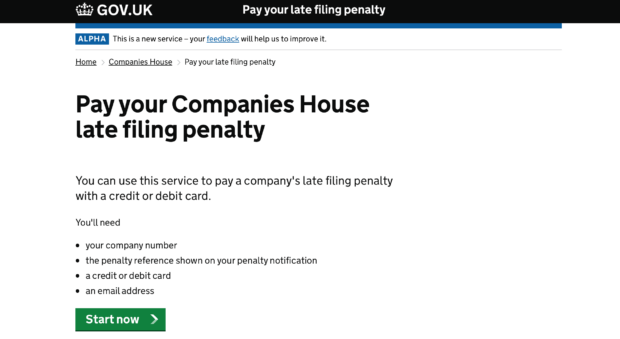

Companies house late filing penalties to enable companies house to maintain the statutory information provided for the public record late filing penalties were introduced by companies house to encourage limited companies to file their accounts on time this ensures that the information contained in the register is kept as up to date as possible. In those days there were no late filing penalties. You will find a link to the online service on your penalty notice.

The reference number on the penalty. Appeal a late filing penalty. If your late filing penalty occurred on or after 30 march 2020 you may be able to pay your late filing penalty online.

Only ever once had directors personally prosecuted for non filing about 30 years ago. If they were not delivered to companies house until 15 july 2010 the company will incur a late filing penalty of 150. Delay in filing corporation tax return can result in the following penalties.

The registrar of companies already has policies in place to deal with appeals based upon unforeseen poor health. Use this service to appeal a penalty issued to a company for not filing its annual accounts on time. Use this service if youve received a penalty notice from companies house for filing your companys annual accounts late.

Think they got about a 50 fine each. Youll have to pay penalties if you dont file your company tax return form ct600 by the deadline. Youll automatically receive a penalty.

If a companys corporation tax return is late three times in a row the 100 penalties are increased to 500 each. Appeals based upon covid 19 will be considered under these policies.

More From House Prices Glasgow Road Blantyre

- House Prices Geraldine Road Sw18

- Falsa Mazze Di Tamburo Velenose

- Mazza Di Tamburo Si Mangia

- Sick Tamburo La Mia Stanza Testo

- House Prices Bali Indonesia

Incoming Search Terms:

- Late Filing Penalties Companies House Hmrc Online Account Filing House Prices Bali Indonesia,

- Business Ip Centre On Twitter If You Run A Limited Company You Can Apply For A 3 Month Extension To File Your Accounts With Companieshouse Allowing You To Manage The Impact Of House Prices Bali Indonesia,

- Company Secretarial Services Dewanis Chartered Accountants House Prices Bali Indonesia,

- Latest Companies House Presentation Nov 2014 House Prices Bali Indonesia,

- How To Tell Hmrc A New Company Is Dormant House Prices Bali Indonesia,

- What Are The Hmrc Late Filing Penalties For Limited Companies Ycf House Prices Bali Indonesia,