Companies House Late Filing Penalties Pay, How To Avoid A Late Filing Penalty Companies House

Companies house late filing penalties pay Indeed recently is being hunted by users around us, perhaps one of you. People are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the name of the article I will discuss about Companies House Late Filing Penalties Pay.

- First Time Directors Presentation August 2014

- Allan Noble Ltd Companies House Late Filing Penalties

- Hmrc Vat And Paye Late Payment Penalties And Interest Rates Company Debt

- Late Filing Penalties Appeals Pdf Free Download

- Companies House Presentation July 2014

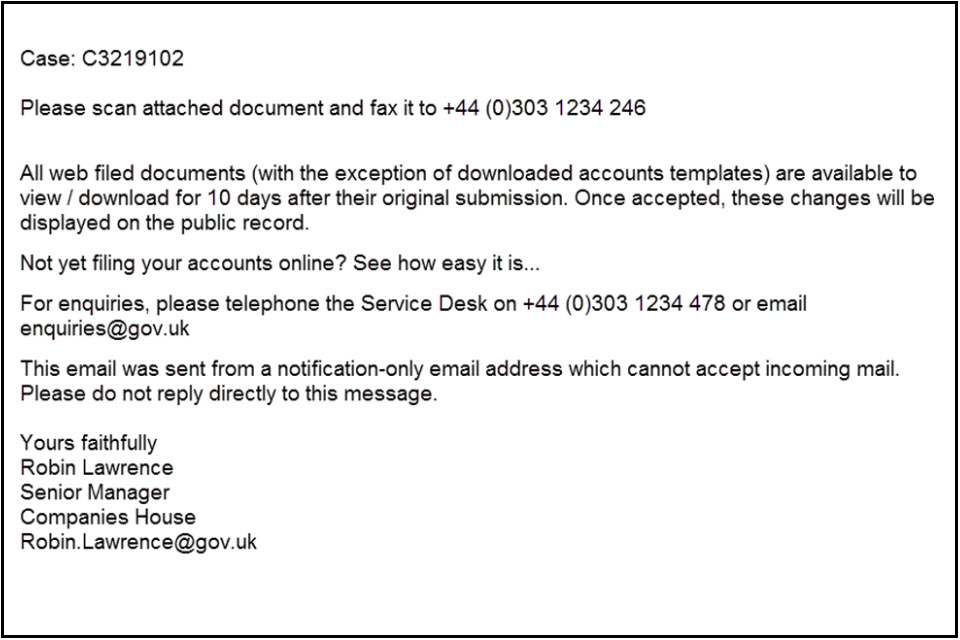

- Known Fraud And Scams Gov Uk

Find, Read, And Discover Companies House Late Filing Penalties Pay, Such Us:

- Companies House Beta Late Filing Penalty Payment

- Late Filing Penalties Accountancy Services In Buckingham

- Companies House Late Filing Penalties Churchgates

- Known Fraud And Scams Gov Uk

- Latest Companies House Presentation Nov 2014

If you re searching for House At The End Of The Street Elissa you've reached the perfect place. We have 101 graphics about house at the end of the street elissa including pictures, pictures, photos, backgrounds, and more. In such web page, we additionally have variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

It may take up to 30 minutes to complete this application.

House at the end of the street elissa. More than 6 months. 3 to 6 months. Pay late filing penalty by cheque.

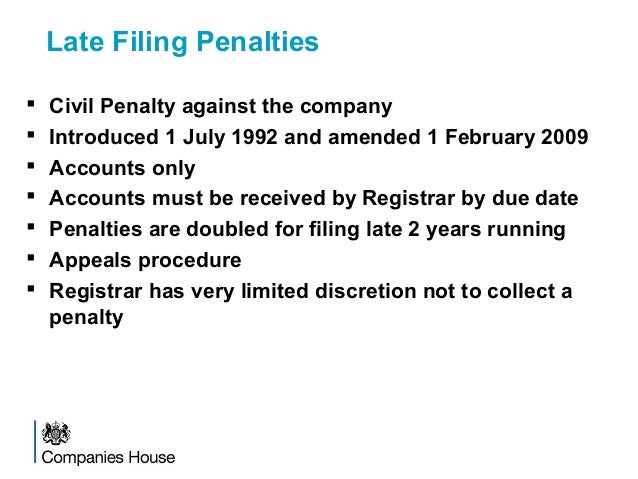

Pay a penalty for filing your company accounts late use this service if youve received a penalty notice from companies house for filing your companys annual accounts late. Paye late filing of rti submissions result in automatic hmrc penalties of 100 per late submission. If your late filing penalty occurred on or after 30 march 2020 you may be able to pay your late filing penalty online.

Use this service to appeal a penalty issued to a company for not filing its annual accounts on time. Penalties for late filing penalties for late filing youll have to pay penalties if you do not file your accounts with companies house by the deadline. You have 30 days from the date on the paye late penalty notice to pay or appeal it.

A private companys set of acceptable accounts for the accounting period ending 30 september 2009 would need to be delivered by 30 june 2010 to avoid a late filing penalty. So the current tax year is 6 april 2020 to 5 april 2021. In this article youll find the full breakdown of all the late filing penalties and late payment fines which hmrc andor companies house may charge in case of any sort of non compliances.

Time after the deadline penalty for private limited companies up to 1 month. You will find a link to the online service on your penalty notice. The reference number on the penalty notice.

For late filing of accounts companies house penalties start at 150 when accounts are 1 day late increasing to 1500 if accounts are delivered over 6 months late. Youll have to pay companies house late filing penalties if you dont file your accounts with companies house by the deadline. How to pay a paye late payment or filing penalty including payment methods reference numbers.

Universally your company may pay your late filing penalty by a number of methods acceptable with companies house. 1 to 3 months. A companies house account youll be able to create one if you do not have one already.

Thereafter you have to send the cheque to the correct companies house offices. Appeal a late filing penalty.

More From House At The End Of The Street Elissa

- Haunting Of Hill House Season 2

- House For Sale New Jersey Shore

- Calibres De Pistolas Y Revolveres

- House For Sale Quebec Road Norwich

- Freno A Tamburo Sh 125

Incoming Search Terms:

- How To Pay Companies House Late Filing Penalties Dns Accountants Freno A Tamburo Sh 125,

- Late Filing Penalties Accountancy Services In Buckingham Freno A Tamburo Sh 125,

- How To Tell Hmrc A New Company Is Dormant Freno A Tamburo Sh 125,

- Online Accounting And Tax Services Online Account Filing Freno A Tamburo Sh 125,

- Iras Late Filing Or Non Filing Of Tax Returns Freno A Tamburo Sh 125,

- Allan Noble Ltd Companies House Late Filing Penalties Freno A Tamburo Sh 125,