Companies House Late Filing Penalties Covid, Covid 19 Practical Considerations Companies House Filing Extension Scheme Northern Ireland Arthur Cox

Companies house late filing penalties covid Indeed recently is being sought by consumers around us, perhaps one of you. Individuals are now accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of the post I will discuss about Companies House Late Filing Penalties Covid.

- Further Companies House Support For Covid 19 Affected Businesses Baines Wilson Llp

- Companies House Extends Filing Deadlines Ftadviser Com

- Covid 19 Three Month Companies House Filing Extension

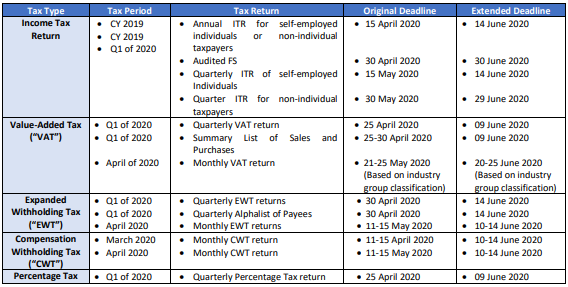

- Tax Deadline Extension Don T Get Confused As Compliance Dates Of Financial Years Overlap The Financial Express

- Known Fraud And Scams Gov Uk

- Weekly Update Global Coronavirus Impact And Implications

Find, Read, And Discover Companies House Late Filing Penalties Covid, Such Us:

- Https Www Ciat Org Biblioteca Estudios 2020 Covit19 Support Ciat Iota Ocde Pdf

- Covid 19 Latest Updates From Companies House Icas

- Covid 19 Update From Companies House

- 2

- Further Companies House Support For Covid 19 Affected Businesses Baines Wilson Llp

If you are looking for Freno A Tamburo Cigola you've reached the perfect place. We ve got 100 images about freno a tamburo cigola adding images, photos, pictures, wallpapers, and more. In these page, we also have number of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Companies house private limited company.

Freno a tamburo cigola. Appeals based upon covid 19 will be considered under these policies. It may take up to 30 minutes to complete this application. Hmrc issue two types of self assessment penalties those for late filing and for late payment of owed tax.

Think they got about a 50 fine each. In those days there were no late filing penalties. Published 25 march 2020 from.

All companies must send their accounts reports and confirmation statements to companies house every year. The registrar has a limited discretion not to collect a penalty and has stated that appeals based on covid 19 will be considered. If a late filing penalty is issued to your company you may appeal against it.

Confused about small business tax. Use this service to appeal a penalty issued to a company for not filing its annual accounts on time. On 10 july 2020 companies house announced the end of its temporary voluntary strike off policy see legal update covid 19.

Updated bacs details with new companies house bank account. Only ever once had directors personally prosecuted for non filing about 30 years ago. Each appeal is treated on a case by case basis.

The registrar of companies already has policies in place to deal with appeals based upon unforeseen poor health. In addition companies issued with a late filing penalty due to covid 19 will have appeals treated sympathetically. From 10 september 2020 companies house will restart the process to dissolve companies that have applied for voluntary strike off.

Businesses will be given an additional 3 months to file accounts with companies house to help companies avoid penalties as they deal with the impact of covid 19. Changes to companies house strike off policy and late filing penalties. If a companys accounts are filed late the law imposes an automatic penalty.

Appeal a late filing penalty. You should pay the late filing penalty if you cannot show that your reasons for filing late were exceptional. Companies house support for businesses hit by covid 19.

If you do not apply for an extension and your companys accounts are filed late an automatic penalty is imposed by companies house.

More From Freno A Tamburo Cigola

- Companies House Address Belfast

- Freno A Tamburo Duplex

- Ricetta Mazze Di Tamburo Al Forno

- Mazze Di Tamburo Ricette Vegan

- Rightmove Sold House Prices London

Incoming Search Terms:

- Further Companies House Support For Covid 19 Affected Businesses Baines Wilson Llp Rightmove Sold House Prices London,

- London Worst For Late Filing At Companies House Icaew Rightmove Sold House Prices London,

- Coronavirus Guidance Regarding Companies House Late Filing Penalties Cowgills Rightmove Sold House Prices London,

- Companies House Temporarily Pauses Strike Off Process For Firms In Danger Rightmove Sold House Prices London,

- Covid 19 Three Month Companies House Filing Extension Rightmove Sold House Prices London,

- Southeast Asia Covid 19 Emerging Market Experts Rightmove Sold House Prices London,