Companies House Late Filing Penalties Account Details, Https Www Ciat Org Biblioteca Estudios 2020 Covit19 Support Ciat Iota Ocde Pdf

Companies house late filing penalties account details Indeed lately has been sought by consumers around us, perhaps one of you. Individuals now are accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the name of this post I will talk about about Companies House Late Filing Penalties Account Details.

- Limited Company Director S Responsibilities Explained Crunch

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctcassxqozsygbpa De99dq53nbc Nnombcvtz 3fwkdntt9biq Usqp Cau

- Https Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File 633763 Companieshouse Annualreport 2017 Web Version Pdf

- Https Www Ciat Org Biblioteca Estudios 2020 Covit19 Support Ciat Iota Ocde Pdf

- The Essentials Of Regulation What You Need To Know

- Https Www2 Deloitte Com Content Dam Deloitte Id Documents Tax Id Tax Indonesian Tax Guide 2019 2020 En Pdf

Find, Read, And Discover Companies House Late Filing Penalties Account Details, Such Us:

- How To Pay Companies House Late Filing Penalties Dns Accountants

- Dormant Company Accounts Saving You Time And Money

- Section 234f Penalty For Late Filing Of Income Tax Return Tax2win

- How To Pay Companies House Late Filing Penalties Dns Accountants

- 3

If you re looking for House To Rent you've arrived at the right place. We ve got 104 graphics about house to rent adding images, pictures, photos, wallpapers, and more. In these webpage, we also have variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

A companies house account youll be able to create one if you do not have one already.

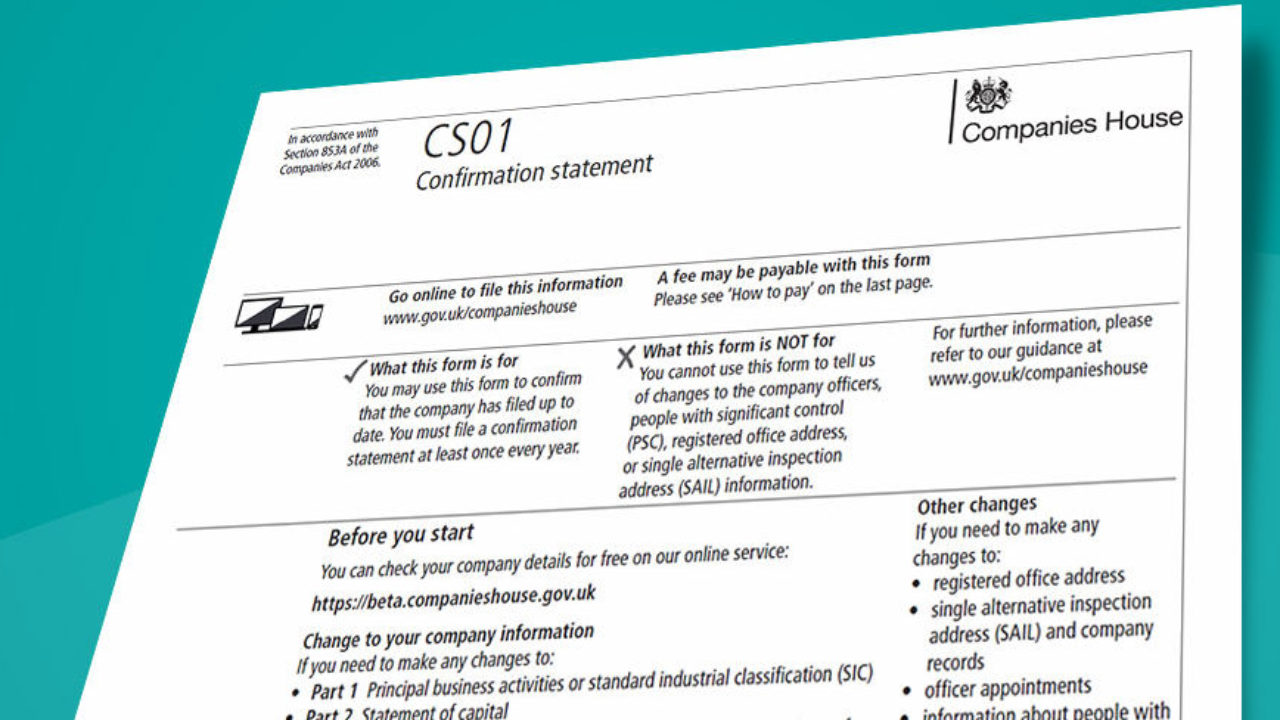

House to rent. A credit or debit card. Late filing penalties were introduced in 1992 to encourage directors of companies to file their accounts and reports on time because this information is required for the public record. Use this service to appeal a penalty issued to a company for not filing its annual accounts on time.

Appeal a late filing penalty. If you miss a filing or payment deadline set by her majestys revenue customs hmrc or companies house youll face immediate penalties and fines which escalate over time. The current penalty for accounts filed up to one month late is 150 increasing on a sliding scale up to.

Each appeal is treated on a case by case basis. Updated bacs details with new companies house bank account. You can be fined and your company struck off the register if you do not send companies house your accounts or confirmation.

Weve got the information you need to help you make sense of the main returns you need to submit and the financial consequences if you dont. The penalty is doubled if your accounts are late 2 years in a row. You can appeal a late filing.

In this article youll find the full breakdown of all the late filing penalties and late payment fines which hmrc andor companies house may charge in case of any sort of non compliances. The registrar of companies already has policies in place to deal with appeals based upon unforeseen poor health. So the current tax year is 6 april 2020 to 5 april 2021.

Appeals based upon covid 19 will be considered under these policies. All companies must send their accounts reports and confirmation statements to companies house every year. If your late filing penalty occurred on or after 30 march 2020 you may be able to pay your late filing penalty online.

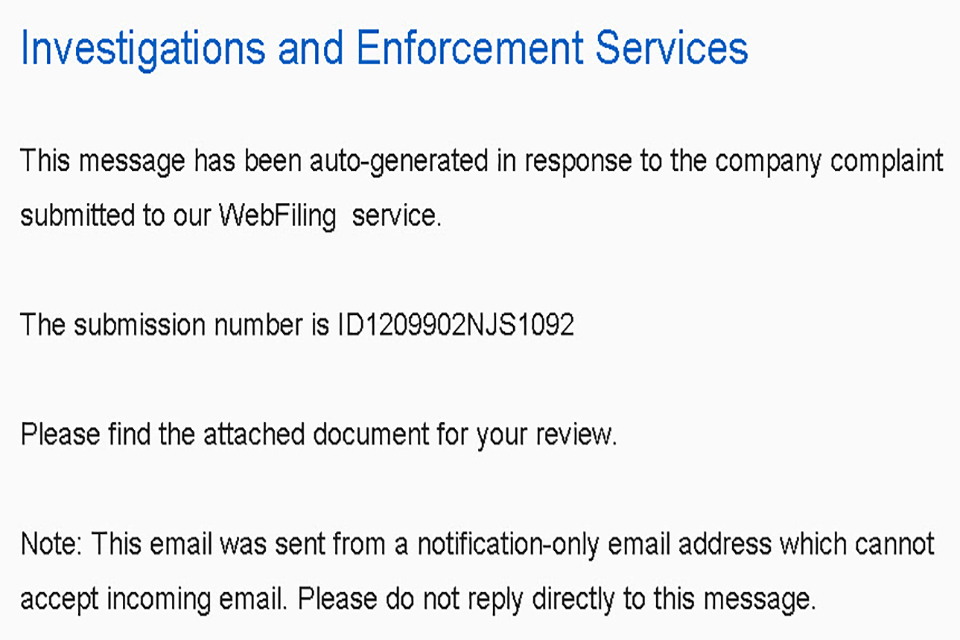

The reference number on the penalty notice. If a companys accounts are filed late the law imposes an automatic penalty. It may take up to 30 minutes to complete this application.

You should pay the late filing penalty if you cannot show that your reasons for filing late were exceptional. Use this service if youve received a penalty notice from companies house for filing your companys annual accounts late.

More From House To Rent

- Companies House Gov

- Freno A Tamburo A Ceppi Flottanti

- House For Sale Essenden Road St Leonards

- Companies House Sic Code 41202

- House For Sale Reykjavik Iceland

Incoming Search Terms:

- Filing Dormant Company Accounts Online Inform Direct House For Sale Reykjavik Iceland,

- Saint Lucia Indirect Tax Guide Kpmg Global House For Sale Reykjavik Iceland,

- Dormant Company Accounts Saving You Time And Money House For Sale Reykjavik Iceland,

- How To File A Confirmation Statement House For Sale Reykjavik Iceland,

- What Are A Company S Annual Accounts House For Sale Reykjavik Iceland,

- Year End Accounting From 28 Mazuma Accountants House For Sale Reykjavik Iceland,