Companies House Penalties, Filing Opticians Accounts At Companies House Morris Co Cheshire

Companies house penalties Indeed lately is being hunted by users around us, perhaps one of you. People now are accustomed to using the net in gadgets to view image and video data for inspiration, and according to the name of the post I will talk about about Companies House Penalties.

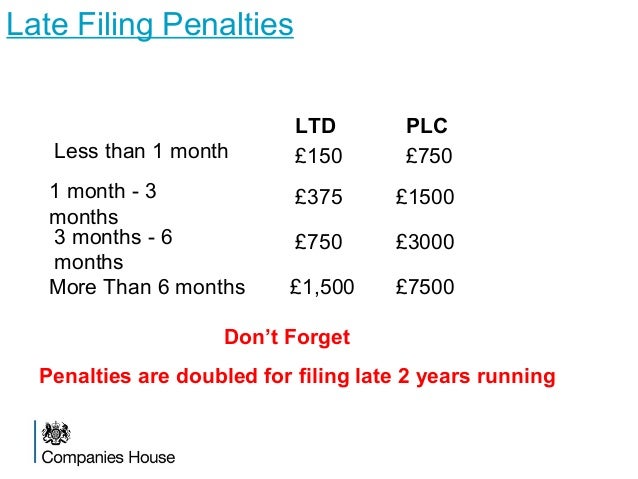

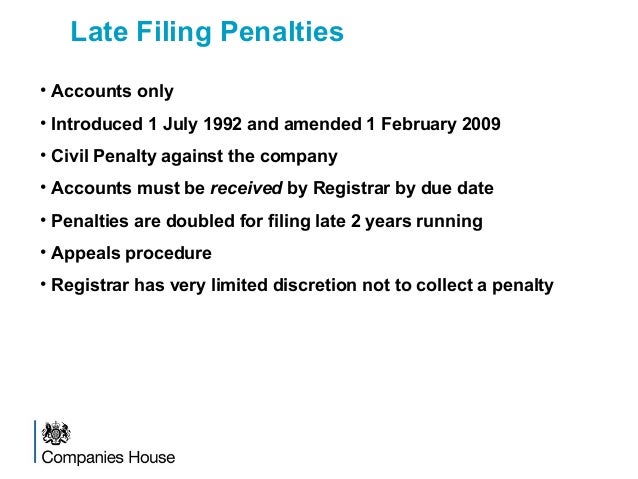

- Late Filing Penalties Companies House Hmrc Online Account Filing

- Late Filing Penalties Appeals Pdf Free Download

- No One Likes Penalties Companies House

- Belluzzo International Partners Businesses Will Be Given An Additional 3 Months To File Accounts With Companies House To Help Companies Avoid Penalties As They Deal With The Impact Of Covid 19

- Filing Opticians Accounts At Companies House Morris Co Cheshire

- Important Fraud Notice From Companies House Warning Late Filing Penalty Scam Company Formation Madesimple

Find, Read, And Discover Companies House Penalties, Such Us:

- Business Alert Companies House Extends Accounts Filing Deadline Royds Withy King

- Companies House Late Filing Penalties Churchgates

- Belluzzo International Partners Businesses Will Be Given An Additional 3 Months To File Accounts With Companies House To Help Companies Avoid Penalties As They Deal With The Impact Of Covid 19

- Known Fraud And Scams Gov Uk

- Late Filing Penalties Appeals Pdf Free Download

If you re searching for House For Sale Courtenay Bc you've arrived at the ideal place. We have 101 graphics about house for sale courtenay bc adding images, pictures, photos, wallpapers, and much more. In such webpage, we also provide variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

If a companys corporation tax return is late three times in a row the 100 penalties are increased to 500 each.

House for sale courtenay bc. The penalties will be doubled if a company files its accounts late in 2. Hmrc will estimate the companys corporation tax bill and add a penalty of 10 the unpaid tax. Guidance for limited companies partnerships and other company types.

Use this service to appeal a penalty issued to a company for not filing its annual accounts on time. Another 10 of any unpaid tax. Youll have to pay penalties if you dont file your company tax return form ct600 by the deadline.

You should pay the late filing penalty if you cannot show that your reasons for filing late were exceptional. Information correct as at 1 st september 2020. It may take up to 30 minutes to complete this application.

Companies house have been acting quickly to strike off a company when the company does not file the confirmation statement or accounts on time. If your tax return is six months late hmrc will write telling you how much corporation tax they think you must pay. Appeal a late filing penalty.

Filing your companies house information online.

More From House For Sale Courtenay Bc

- Japanese House For Sale

- Harry Potter Hogwarts House Descriptions

- Haunting Of Hill House Theo

- Rightmove Sold House Prices Scotland

- Mazze Di Tamburo Ricette

Incoming Search Terms:

- 2 Mazze Di Tamburo Ricette,

- Penalties Removed Numbers Uk Ltd Mazze Di Tamburo Ricette,

- Late Filing Penalties Companies House Hmrc Online Account Filing Mazze Di Tamburo Ricette,

- Mph Accountants Business Advisors Mazze Di Tamburo Ricette,

- Companies House Support For Businesses Hit By Covid 19 Gov Uk Mazze Di Tamburo Ricette,

- How To Pay Companies House Penalties Companies House Bank Details Xero Accountants Mazze Di Tamburo Ricette,