Companies House Penalties Payment, Late Filing Penalties Gov Uk

Companies house penalties payment Indeed recently has been hunted by consumers around us, maybe one of you. Individuals are now accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the title of this article I will discuss about Companies House Penalties Payment.

- Late Filing Penalties Companies House Hmrc Online Account Filing

- Prepayment Penalty What It Is And How To Avoid It Rocket Mortgage

- 5 Tips To Help You File Your Accounts On Time Companies House

- Latest Companies House Presentation Nov 2014

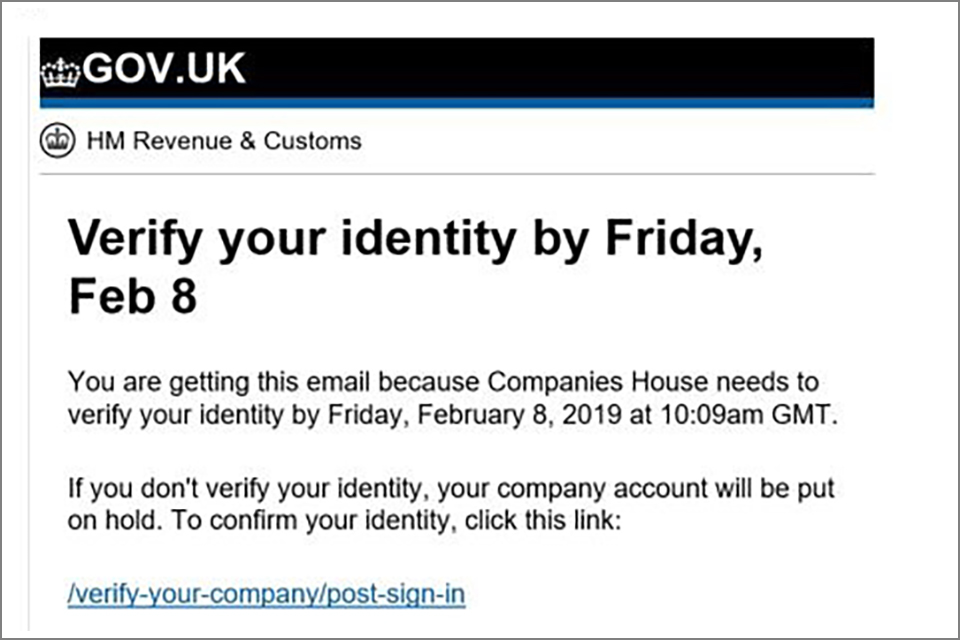

- Important Fraud Notice From Companies House Warning Late Filing Penalty Scam Company Formation Madesimple

- Companies House Clampdown On Incorrect Filings Solicitors In Portsmouth Waterlooville Verisona Law

Find, Read, And Discover Companies House Penalties Payment, Such Us:

- Companies House Changes Late Filing Penalties Manual Kob Limited

- 25 000 Companies Receive Penalties For The Late Filing Of Accounts In Just One Month Knights Lowe

- What S In The Covid 19 Aid Bill Make Direct Payments To Americans Lift Penalties On Companies Stock Portfolios The Gazette

- Penalties Accountingweb

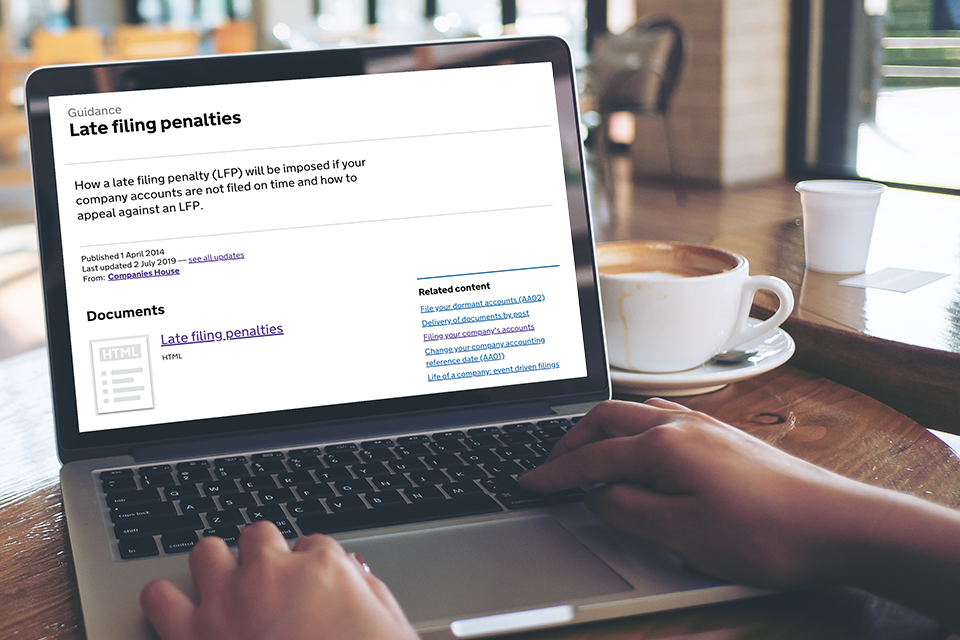

- Changes To Our Late Filing Penalties Manual Gov Uk

If you re searching for Mazza Di Tamburo Tossica you've reached the ideal place. We have 101 images about mazza di tamburo tossica adding images, photos, photographs, backgrounds, and more. In such webpage, we also have number of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Companies House Clampdown On Incorrect Filings Solicitors In Portsmouth Waterlooville Verisona Law Mazza Di Tamburo Tossica

To help you stay on top of your legal obligations heres a rundown of the important deadlines you must meet and the potential penalties imposed for non compliance.

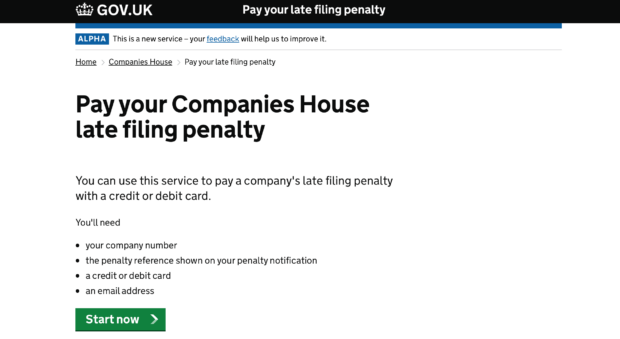

Mazza di tamburo tossica. For the last few months a small team of us have been working on a new service for companies to pay their late filing penalties online. If you miss a filing or payment deadline set by her majestys revenue customs hmrc or companies house youll face immediate penalties and fines which escalate over time. In this article youll find the full breakdown of all the late filing penalties and late payment fines which hmrc andor companies house may charge in case of any sort of non compliances.

Weve got the information you need to help you make sense of the main returns you need to submit and the financial consequences if you dont. The self assessment tax year runs from 6 april to 5 april next year. Youll find your company number on your penalty notice.

Paying your lfp by bacs only. So the current tax year is 6 april 2020 to 5 april 2021. You can pay using bacs payment.

Ksi have a letter from companies house with an online link but the link just brings me into the web page explaining penalties and how to file etc. It usually takes up to 3 working days for your payment to reach companies house. I work on delivering digital services to our users.

The level of the penalty depends on how late the accounts reach companies house and is shown in the following table. Updated bacs details with new companies house bank account. Length of period measured from the date the accounts are due private company.

Paye late filing of rti submissions result in automatic hmrc penalties of 100 per late submission. Check your banks transaction limits and processing times before making a payment. Also the message below says i cant pay if penalty was after 30th march 2020.

A how to pay your penalty page has been added to the gp5 pdf. How to pay a paye late payment or filing penalty including payment methods reference numbers bank account details and deadlines. My name is amy harcombe and im lead product manager at companies house.

More From Mazza Di Tamburo Tossica

- Tamburo Per Stampante Brother Mfc 7360n

- The Haunting Of Hill House Luke Crain

- Le Mazze Di Tamburo Si Possono Surgelare

- House For Sale Sanur Bali

- Companies House The Hut Group

Incoming Search Terms:

- Belluzzo International Partners Businesses Will Be Given An Additional 3 Months To File Accounts With Companies House To Help Companies Avoid Penalties As They Deal With The Impact Of Covid 19 Companies House The Hut Group,

- Known Fraud And Scams Gov Uk Companies House The Hut Group,

- Coronavirus If Your Company Cannot File Accounts With Companies House On Time Gov Uk Companies House The Hut Group,

- Late Filing Penalties Gov Uk Companies House The Hut Group,

- Companies House Moneyclaimsuk Companies House The Hut Group,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctb1rawk6pi7vgibn6sp9sat3k4ff8v4rcxh1jcgvreu3kl8jir Usqp Cau Companies House The Hut Group,