Companies House Penalties Late Filing, Companies House Paul Hughes Event Team Who We Are Uk Registry Of Companies Established Executive Agency Of Bis Trading Fund Funding Ppt Download

Companies house penalties late filing Indeed lately is being sought by users around us, maybe one of you personally. People are now accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of this article I will talk about about Companies House Penalties Late Filing.

- Business Alert Companies House Extends Accounts Filing Deadline Royds Withy King

- 25 000 Companies Receive Penalties For The Late Filing Of Accounts In Just One Month M J Bushell

- Hmrc Companies House Late Filing Penalties In Uk Dns Accountants

- Category Filing Penalty Companies 999 Blog

- Calendar Of Key Tax And Filing Dates Startup Donut Time Management Tools Dating Calendar

- Late Filing Penalties For Limited Companies Company Bug

Find, Read, And Discover Companies House Penalties Late Filing, Such Us:

- Hmrc Companies House Late Filing Penalties In Uk Dns Accountants

- Coronavirus Three Month Extension For Firms To File Accounts

- Service Assessment Paying Late Filing Penalties Online Companies House

- Hmrc Penalty Appeal What S A Reasonable Excuse

- Companies House Deadlines And Coronavirus Kp Simpson

If you re searching for Mazze Di Tamburo Buone E Velenose you've reached the perfect location. We ve got 100 images about mazze di tamburo buone e velenose adding pictures, photos, photographs, wallpapers, and much more. In such page, we also provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Late filing penalties were introduced in 1992 to encourage directors of companies to file their accounts and reports on time because this information is.

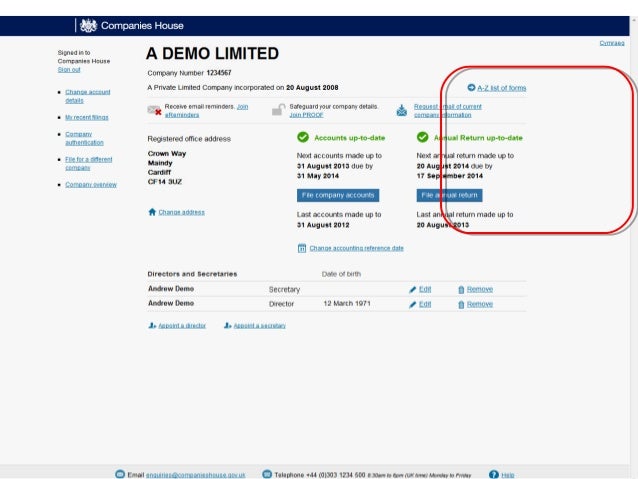

Mazze di tamburo buone e velenose. A companies house account youll be able to create one if you do not have one already. Late filing penalties explained. Confused about small business tax.

The self assessment tax year runs from 6 april to 5 april next year. If your late filing penalty occurred on or after 30 march 2020 you may be able to pay your late filing penalty online. Unfortunately i filed the last set of dormant accounts late with companies house and have received a 750 penalty.

You can appeal a late filing. Think they got about a 50 fine each. Self assessment you must submit your annual self assessment tax return and pay any tax you owe for the previous tax year by 31 january each year.

A credit or debit card. You should pay the late filing penalty if you cannot show that your reasons for filing late were exceptional. Many companies do not inform companies house of changes to their officers within the 14 day period set out in the companies act 2006.

It may take up to 30 minutes to complete this application. The reference number on the penalty notice. Hmrc issue two types of self assessment penalties those for late filing and for late payment of owed tax.

Updated bacs details with new companies house bank account. Whilst late filing of changes to their officers has never been recommended it is a breach of the companies act 2006 and may result in a fine for the company and its officers doing so may now affect a company. So next time appoint an accountant who would have been able to advise how to avoid this or more probably not incur it in the first place.

Only ever once had directors personally prosecuted for non filing about 30 years ago. Companies house late filing penalties to enable companies house to maintain the statutory information provided for the public record late filing penalties were introduced by companies house to encourage limited companies to file their accounts on time this ensures that the information contained in the register is kept as up to date as possible. In those days there were no late filing penalties.

Use this service to appeal a penalty issued to a company for not filing its annual accounts on time. Use this service if youve received a penalty notice from companies house for filing your companys annual accounts late. Appeal a late filing penalty.

More From Mazze Di Tamburo Buone E Velenose

- House For Sale Aurora Ohio

- Harry Potter House Symbols Printable

- House For Sale Essenden Road St Leonards

- Companies House Qinetiq

- Pistole A Tamburo Migliori

Incoming Search Terms:

- Annual Accounts Late Filing And Blue Peak Accounting Facebook Pistole A Tamburo Migliori,

- January 2011 Company Law Update Stanley Davis Group Ltd Pistole A Tamburo Migliori,

- Late Filing Penalties Accountancy Services In Buckingham Pistole A Tamburo Migliori,

- What Are The Hmrc Late Filing Penalties For Limited Companies Ycf Pistole A Tamburo Migliori,

- Coronavirus Three Month Extension For Firms To File Accounts Pistole A Tamburo Migliori,

- Companies House Late Filing Penalties In The Uk Pistole A Tamburo Migliori,