Japanese House Prices Since 1990, Https Www Dallasfed Org Media Documents Institute Wpapers 2014 0208 Pdf

Japanese house prices since 1990 Indeed lately has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the net in gadgets to see video and image data for inspiration, and according to the title of this post I will talk about about Japanese House Prices Since 1990.

- How Many More Years Before We See A Housing Recovery Sell Buy Or Rent Thepropertypin

- Where The American Dream Goes To Die Changes In House Prices Rents And Incomes Since 1960 By Region Metro Wolf Street

- How Tokyo Built Its Way To Abundant Housing James Gleeson

- A History How Housing Became The World S Biggest Asset Class Special Report The Economist

- Real Estate Bubble Wikipedia

- Where The American Dream Goes To Die Changes In House Prices Rents And Incomes Since 1960 By Region Metro Wolf Street

Find, Read, And Discover Japanese House Prices Since 1990, Such Us:

- This Is What A Bubble Looks Like Japan 1989 Edition Investing Com

- Japan S New Apartment Price To Income Ratios Reach 24 Year High Japan Property Central

- Comparing The Us And Japanese Housing Bubbles Seattle Bubble

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrvm Oybrscy219yxwushlqiw9kri98ap59poceplhpbxnuf4la Usqp Cau

- Please Check And Revise My Essay Of Ielts 65292 Many Thanks Preparation For And Help With The Toefl Test And Toeic Toefl English Learning Forum

If you are looking for Tamburo Di Latta you've reached the right place. We have 104 graphics about tamburo di latta including images, pictures, photos, backgrounds, and more. In these page, we additionally have number of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

In early 1992 this price bubble burst and japans economy stagnated.

Tamburo di latta. In the years that followed the japanese surveyed an alien landscape of restructuring code for cost. In february 2020 the central banks policy rate stood at 010 unchanged since january 2016. From 1991 to 2003 the japanese economy as measured by gdp grew only 114 annually well below that of other industrialized nations.

In 2012 it was 45400000 yen. Residential property values in japan are now back to levels last seen in 1983. Japan is an important case example because in 1990 japan had a gdp of 31 trillion and the us was at 57 trillion.

Japanese house prices rents and letting income real data. According to lynch myriad factors have affected the housing system and property prices in the last 50 years. The japanese asset price bubble baburu keiki bubble economy was an economic bubble in japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated.

Housing experienced an average inflation rate of 419 per yearthis rate of change indicates significant inflation. Graph of house price trends in japan. Since then however prices have increased and we are not in the middle of a stable period of growth with a positive outlook for the future.

In 1991 apartment prices peaked at a nationwide average of 44880000 yen. But today japans gdp is what it was in 1995. Between 1967 and 2020.

In greater tokyo the average price was 11710000 yen in 1973. Bureau of labor statistics prices for housing were 78043 higher in 2020 versus 1967 a 78043230 difference in value. Japan prices back to 1983 levels.

Prices for housing 1967 2020 100000 according to the us. The stock market plummeted losing more than 2tn 15tn in value by december 1990. In greater tokyo they peaked in 1990 at 61230000 yen.

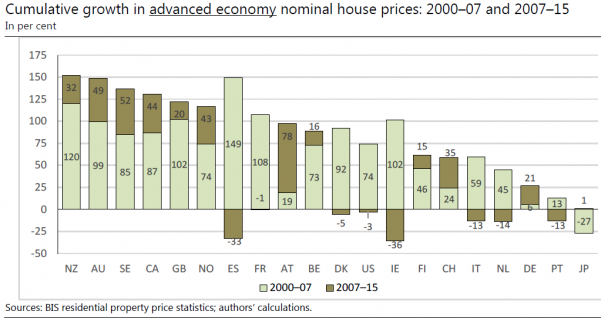

The bubble was characterized by rapid acceleration of asset prices and overheated economic activity as well as an. From 1960 to 2006 real house prices increased at an average of 27 per cent per annum ahead of a 19 per cent per annum growth per household real income lynch says. In 2012 it was 38340000 yen.

Japan for many years was the second largest economy. Bubble period 1982 to 1990 real estate prices across japan rose by as much as six to seven times during the 1980s asset bubble. The average apartment price nationwide in 1973 was 10860000 yen.

More From Tamburo Di Latta

- Companies House Website Check

- House For Sale In Sydney Nsw

- House For Sale In California City With Pool

- Printable Harry Potter House Traits

- House At The End Of The Street Netflix

Incoming Search Terms:

- What Can You Buy In The Tokyo Suburbs For 230 000 Or Less Blog House At The End Of The Street Netflix,

- Japan Real Residential Property Price Index 1955 2020 Data Charts House At The End Of The Street Netflix,

- Finfacts Ireland Irish Real House Prices Up 175 In 50 Years Uk 405 Germany 1 House At The End Of The Street Netflix,

- Japan Real Residential Property Price Index 1955 2020 Data Charts House At The End Of The Street Netflix,

- The 20 Year Japanese Bear Market In Real Estate Is Making Its Way To The United States Home Prices In The U S Are Now In A Double Dip And Have Gone Back 8 House At The End Of The Street Netflix,

- Bubble Burst House At The End Of The Street Netflix,