Companies House Dormant Company Accounts, Aa02 Dormant Company Accounts Dca Section 441

Companies house dormant company accounts Indeed recently is being sought by users around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about Companies House Dormant Company Accounts.

- Https Www Mcguinnessinstitute Org Wp Content Uploads 2020 04 Companies House 2019 Pdf

- What Is A Confirmation Statement

- 2

- What Are Dormant Companies And Dormant Company Accounts

- Form Aa02

- Dormant Company A Quick Guide

Find, Read, And Discover Companies House Dormant Company Accounts, Such Us:

- Product Detail

- Priceoffootball En Twitter Moneything Is A Dormant Company According To Companies House Which Seems Odd If It Had Lent To Bury

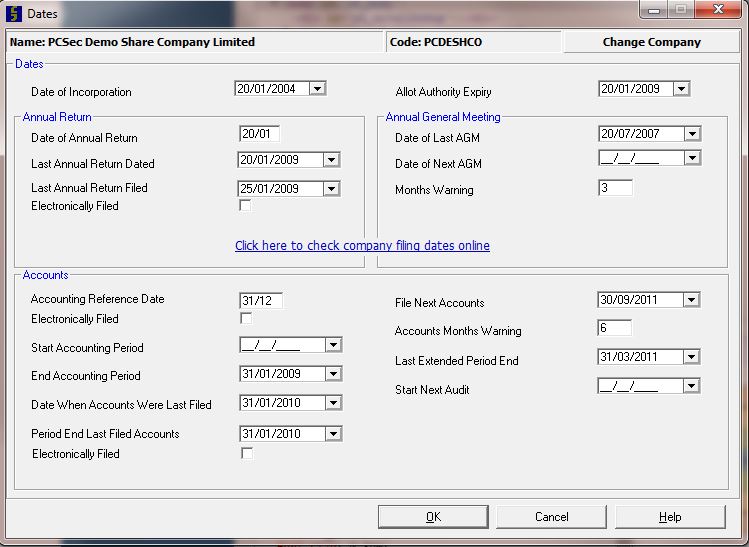

- Filing Dormant Company Accounts Online Inform Direct

- What Is A Confirmation Statement

- Document Filing Service For Companies

If you re looking for Haunting Of Hill House Tall Man Actor you've arrived at the right place. We have 103 images about haunting of hill house tall man actor adding images, pictures, photos, backgrounds, and much more. In such webpage, we also have number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

How To Submit A Dormant Set Of Accounts To Companies House Capium Support Haunting Of Hill House Tall Man Actor

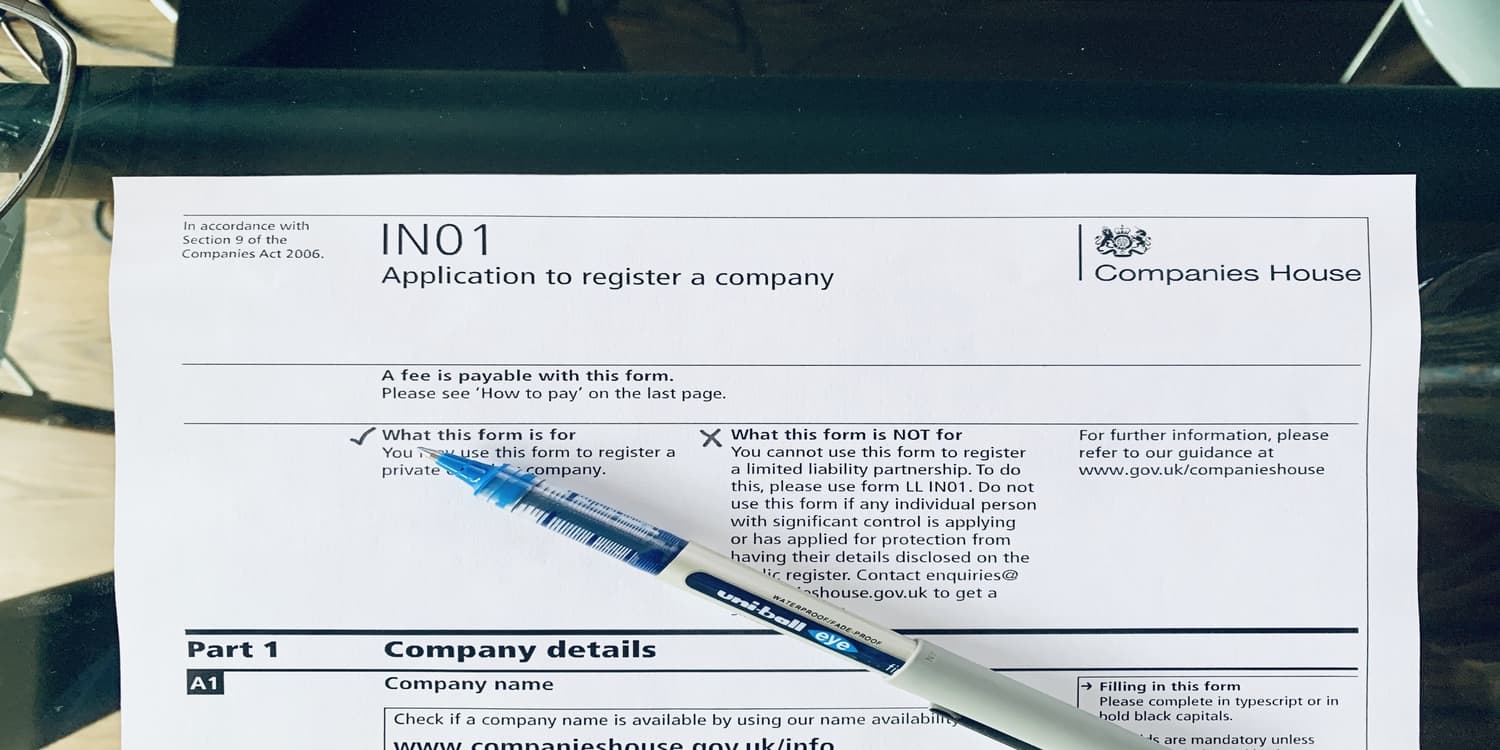

File dormant accounts with companies house before you start.

Haunting of hill house tall man actor. The accounts for your dormant company must be filed with companies house 9 months after the end of the financial year. Allow up to 5 days for delivery of your code. Making an active company dormant.

Its turnover is less than 102 million. As a dormant company you will still need to file annual accounts and a confirmation statement to companies house. Your company is classed as small if it has any two of the following.

What it means to be dormant for corporation tax or companies house trading and non trading annual accounts company tax returns and telling hm revenue and customs hmrc. However if your company is dormant according to companies house and also qualifies as small you can file dormant company accounts without having to include an auditors report. If your company already has a code a reminder will be sent.

To make an active company. Each dormant company is still required to meet certain filing requirements. A company is classified as small if any two of the following apply.

If your company is dormant according to companies house and qualifies as small you can file dormant accounts and you dont have to include an auditors report. Companies house normally approve dormant company accounts within 24 48 hours of receipt and inform direct will automatically email you to confirm this approval once received. Published 29 august 2014.

For security reasons your code cant be provided by email or over the phone. You can file your accounts online and print a copy for your own records. Unaudited dormant accounts are much simpler than those of a trading company.

What it means to be dormant for corporation tax or companies house trading and non trading annual accounts company tax returns and telling hm revenue and customs hmrc. You must do this whether your company is dormant for corporation tax or for companies house. Dormant company accounts submitted to companies house need not include a profit and loss account or directors report.

More From Haunting Of Hill House Tall Man Actor

- Tamburo Africano Negarit

- House Prices Geraldine Road Sw18

- Printable Harry Potter House Traits

- House For Sale Yorkshire Ny

- Sick Tamburo Hiroshima

Incoming Search Terms:

- What Is A Dormant Company Your Company Formations Sick Tamburo Hiroshima,

- What Is Company Formation Sick Tamburo Hiroshima,

- First Time Directors Sick Tamburo Hiroshima,

- What Do I Need To Do If I Haven T Used My Company Sick Tamburo Hiroshima,

- How To File Your Dormant Accounts Youtube Sick Tamburo Hiroshima,

- How To Complete Form Aa02 Dormant Company Accounts 1 Sick Tamburo Hiroshima,