Companies House Dormant Accounts Guidance, How Do I File Dormant Accounts For A Company Limited By Shares Inform Direct Support

Companies house dormant accounts guidance Indeed recently is being sought by consumers around us, perhaps one of you. People now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the title of this post I will talk about about Companies House Dormant Accounts Guidance.

- File Dormant Accounts Small Firms Services Ltd

- Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

- What Are The Benefits Of Dormant Company Swarit Advisors

- How To Submit Ixbrl Accounts To Companies House And Or Hmrc

- How To Submit A Dormant Set Of Accounts To Companies House Capium Support

- File A Confirmation Statement At Companies House Your Company Formations

Find, Read, And Discover Companies House Dormant Accounts Guidance, Such Us:

- Filing Your Company S Accounts Gov Uk

- Nm01 Filing Standard Name Change Electronic Only

- Form Aa02

- How Do I File Dormant Accounts For A Company Limited By Shares Inform Direct Support

- File Dormant Accounts Small Firms Services Ltd

If you re searching for Mazza Di Tamburo Fungo In Francese you've come to the right place. We have 104 images about mazza di tamburo fungo in francese including pictures, photos, photographs, backgrounds, and more. In such web page, we additionally have number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

A company which is dormant for the accounting period for which accounts are prepared that is not a small company.

Mazza di tamburo fungo in francese. Companies house and hmrc dormant company forms. A company which is dormant for the accounting period for which accounts are prepared provided that it is a small company see accounts guidance. The dca is only suitable for dormant companies where the companys.

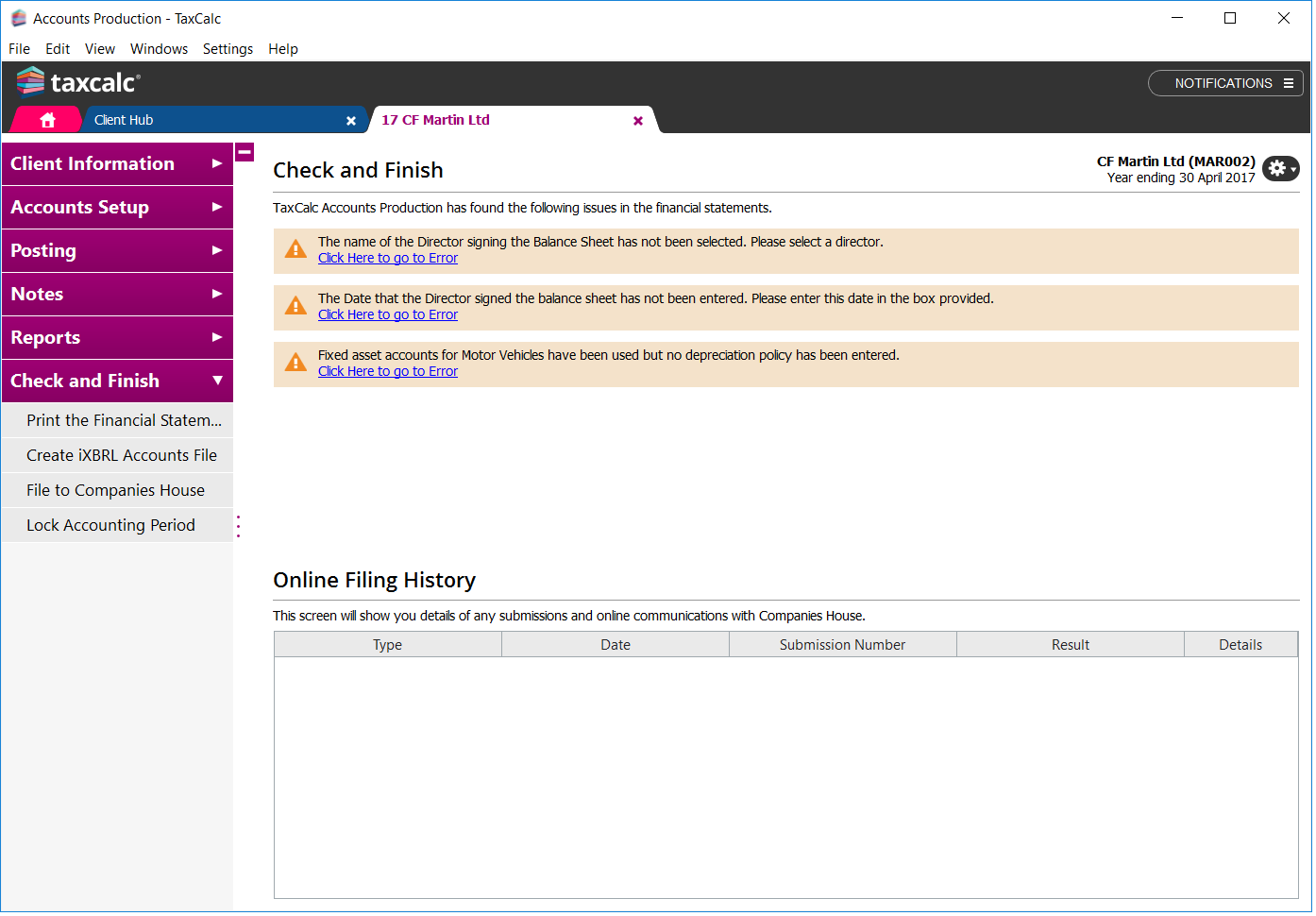

Guidance and support the uk has left the eu. Qualifying dormant companies can deliver even simpler annual accounts to companies house more details are given in our guidance on dormant company accounts. The total of net assets should equal the total of shareholders funds.

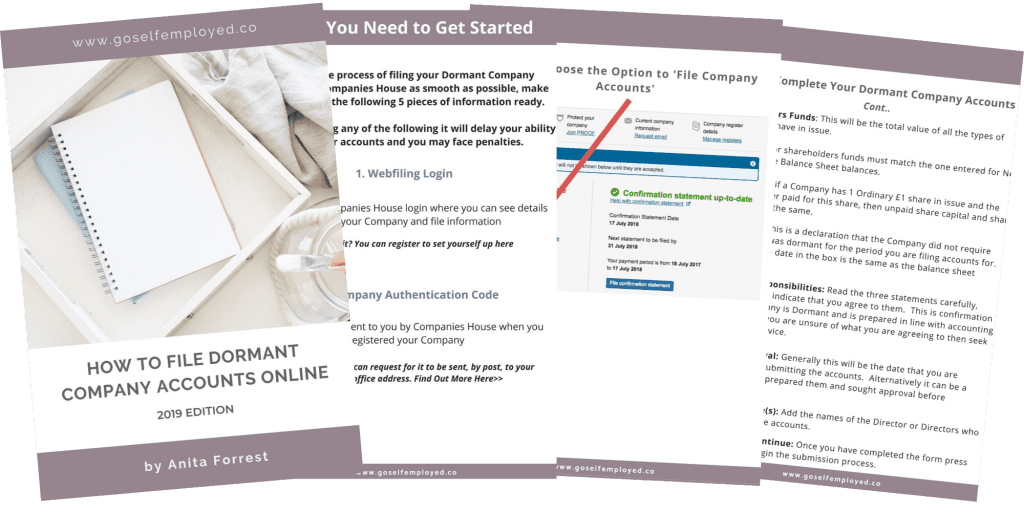

Use this form to submit dormant accounts for a company limited by shares. It does not advise on the preparation of full accounts for the members. For security reasons your code cant be provided by email or over the phone.

The following dormant companies do not have to have their accounts audited. It also means that in certain circumstances abridged and unaudited accounts can be sent to companies house known as dormant company accounts. Allow up to 5 days for delivery of your code.

You can watch our annual accounts video with captions on youtube 1m 45s. Filing your companies house information online. Cic accounts guidance updated.

Updated exemptions from audit as a small company. File dormant company accounts either online or by printing off an aa02 form annually with companies house. This guidance only advises on the preparation of abbreviated dormant accounts which can be filed at companies house.

Guidance changes to companies house forms from 1 january 2021. What are annual accounts. What it means to be dormant for corporation tax or companies house trading and non trading annual accounts company tax returns and telling hm revenue and customs hmrc.

Heres a summary of what you need to do. A dormant company is one thats not carrying out any business activity or receiving an income. This renders it inactive for corporation tax purposes as far as hmrc is concerned.

More From Mazza Di Tamburo Fungo In Francese

- House For Sale Ballina Nsw

- Il Tamburo Di Latta Dvd

- Harry Potter House Traits

- Simile Mazza Di Tamburo Fungo

- House For Sale Sydney West

Incoming Search Terms:

- Coronavirus If Your Company Cannot File Accounts With Companies House On Time Gov Uk House For Sale Sydney West,

- How Do I File Dormant Accounts For A Company Limited By Shares Inform Direct Support House For Sale Sydney West,

- Https Www Mcguinnessinstitute Org Wp Content Uploads 2020 04 Companies House 2019 Pdf House For Sale Sydney West,

- Striking Off A Company House For Sale Sydney West,

- Registered Address Services With Free Mail Forwarding Registered Address Ltd Business Address And Virtual Office Services London House For Sale Sydney West,

- The Register Of People With Significant Control Explained House For Sale Sydney West,