Companies House Bank Details For Penalties, 1yfnemupxiequm

Companies house bank details for penalties Indeed lately has been hunted by users around us, maybe one of you personally. People now are accustomed to using the net in gadgets to view image and video data for inspiration, and according to the title of this article I will talk about about Companies House Bank Details For Penalties.

- Late Filing Penalties For Limited Companies

- How To Pay Companies House Penalties Companies House Bank Details Xero Accountants

- Company Formations And Registrations York Place

- Https Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File 819994 Corporate Transparency And Register Reform Pdf

- Late Filing Penalties Companies House Hmrc Online Account Filing

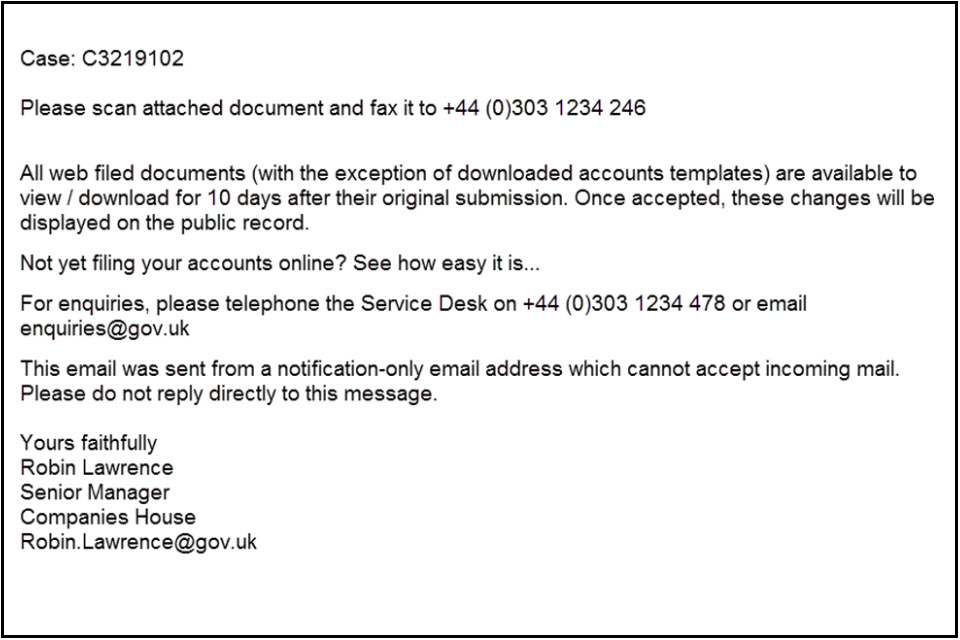

- Known Fraud And Scams Gov Uk

Find, Read, And Discover Companies House Bank Details For Penalties, Such Us:

- Filing Dormant Company Accounts Online Inform Direct

- Filing The Confirmation Statement Or Annual Accounts Late

- January 2011 Company Law Update Stanley Davis Group Ltd

- Pay Late Filing Penalty For Accounts Filed Late Concise Accountancy

- 3

If you re searching for Farm House For Sale Victoria you've come to the perfect place. We ve got 104 images about farm house for sale victoria adding images, pictures, photos, wallpapers, and more. In such web page, we additionally provide variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

National westminster bank branch.

Farm house for sale victoria. Remember to email. Otherwise you may pay your late filing penalty by bank transfer. Paying your lfp by bacs only.

For the last few months a small team of us have been working on a new service for companies to pay their late filing penalties online. I work on delivering digital services to our users. Limited companies are subject to late filing penalties if they fail to meet their statutory obligations for hmrc and companies house.

Confused about small business tax. Companies house bank details. Account namelate filing penalties receipts account no41005309 bank addressnational westminster bank roath cardiff sort code52 21 07 swift code for overseas paymentsnw bk gb 2122x iban.

The penalty notice gives details of the penaltypenalties imposed against the company. Updated bacs details with new companies house bank account. Companies house private limited company.

Companies house bank details have changed all customers who make payments by bank transfer bacs will need to use our new bank account details from 1 september 2020. How to pay a paye late payment or filing penalty including payment methods reference numbers bank account details and deadlines. Appeals manual version 10 published.

Late filing penalties receipts account bank account number. Hmrc issue two types of self assessment penalties those for late filing and for late payment of owed tax. How to pay a paye late payment or filing penalty including payment methods reference numbers bank account details and deadlines.

It shows the last date for filing the date of filing of the accounts and the level of the penalty imposed. To help you stay on top of your legal obligations heres a rundown of the important deadlines you must meet and the potential penalties imposed for non compliance. Companies house bank details are as follows.

Po box 458 207 richmond road cardiff cf24 3ux bank account name.

More From Farm House For Sale Victoria

- House For Sale In New Zealand South Island

- Sostituzione Tamburo Stampante Kyocera

- Companies House Late Filing Penalty Dormant Company

- Tamburo Sciamanico Musica

- Suburbs Auckland House Prices Graph 2020

Incoming Search Terms:

- Service Assessment Paying Late Filing Penalties Online Companies House Suburbs Auckland House Prices Graph 2020,

- 5 Tips To Help You File Your Accounts On Time Companies House Suburbs Auckland House Prices Graph 2020,

- Https Www Mcguinnessinstitute Org Wp Content Uploads 2020 04 Companies House 2019 Pdf Suburbs Auckland House Prices Graph 2020,

- Should I Use A Tax Refund Company Low Incomes Tax Reform Group Suburbs Auckland House Prices Graph 2020,

- Limited Company Loans Ltd Business Finance Up To 500k Suburbs Auckland House Prices Graph 2020,

- Do I Need To Tell Companies House When I Move House Suburbs Auckland House Prices Graph 2020,